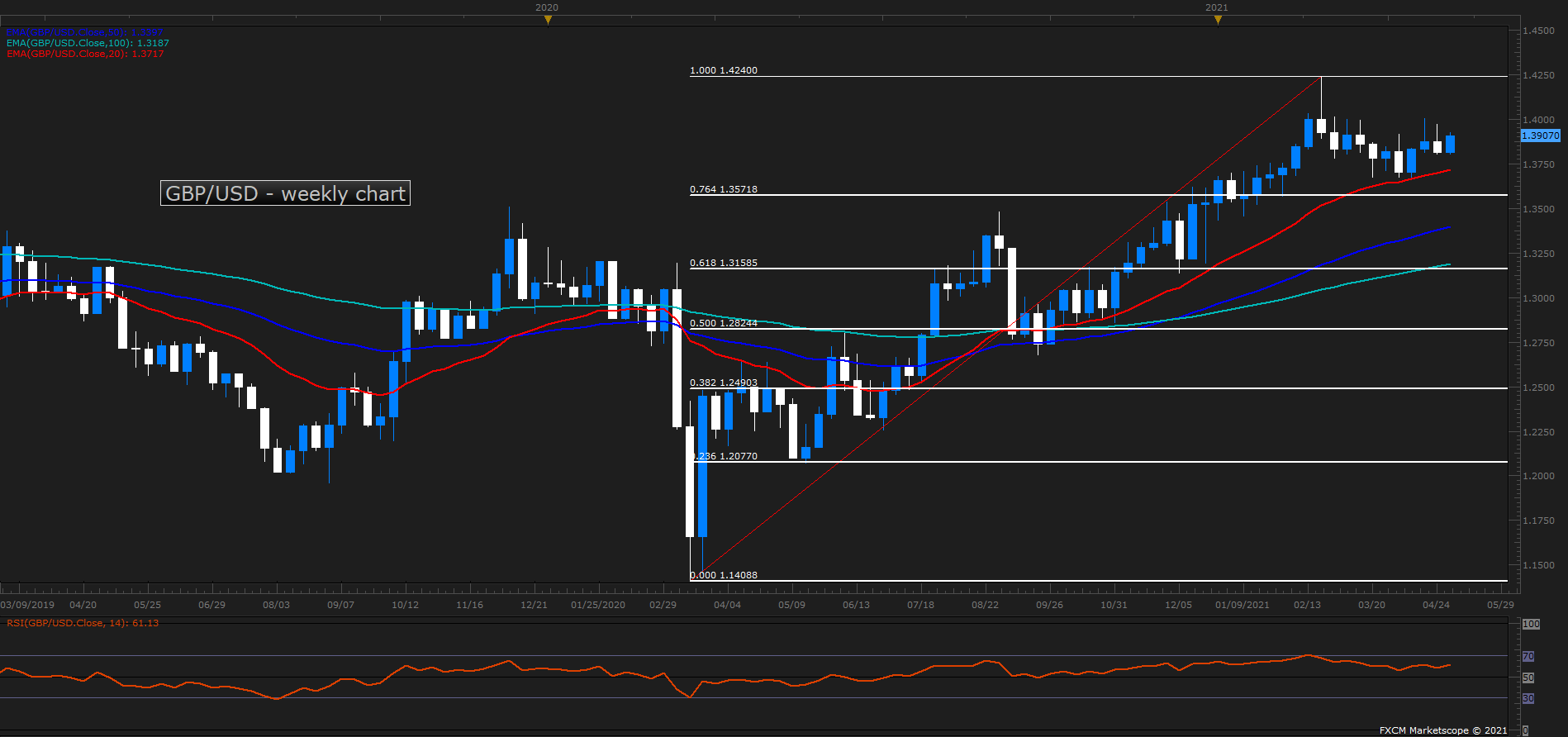

The British Pound plunged more than 0.5% against the US Dollar last week with Sterling reversing sharply off key technical resistance. The threat of a deeper correction within the broader uptrend remains heading into the May open and the battle lines have been drawn. These are the updated targets and invalidation levels that matter on the GBP/USD weekly technical chart

GBP/USD, rebound may have more upside near-term but the broader risk remains for a deeper correction while below 1.4024. The rally stretched higher in the following days with Cable registering a high at 1.4009 before reversing sharply with prices marking a weekly reversal into the close of April.

The major levels remain unchanged into the May open with initial resistance steady at the yearly high-week close at close at 1.3931 backed by near-term bearish invalidation at 1.3997-1.4024- a region defined by the 2018 high-week close and the 61.8% Fibonacci retracement of the February decline. A breach / close above this threshold is needed to mark resumption toward the yearly high / 2018 high-close / 50% retracement at 1.4236-1.43. Weekly support is eyed at the 61.8% extension / Brexit gap at 1.3654/75 backed by more a more significant technical confluence at the 100% extension / 2017 high-week close at 1.3435/94- both areas of interest for possible downside exhaustion IF reached.

Our information/charts are NOT buy/sell recommendations. Are strictly provided for educational purposes only. Trade at your own risk and analysis.

Contact our advisors through website chat 24/7.

Subscribe now to get our exclusive forex education.

https://forexcapitalexperts.com/services